Your Trusted Tax Agents, Serving Online and In-Person

Certificates of SCL Tax Agents Serving NYC, Bronx, NY to Nationwide

Why Choose SCL Tax Agents In & Near Bronx, NY?

When you choose SCL Tax Agents In & Near Bronx, NY, you choose to have your taxes prepared in a professional, warm, and friendly environment with tax agents who are dedicated to meeting your specific tax needs. Come as you are, kick your feet up, and relax! You’ll get the tax services you need! Do your thing, and let us take care of your taxes or as we like to say, “You do life. We do your taxes.” Do you wonder whether you should choose our Bronx and NYC tax professionals or not? Scroll down to make sure you are choosing the right tax agents!

✔ Expert Guidance

✔ Year-Round Availability

✔ Friendly, Transparent Service

✔ 15-Min Free Consultation

Speak to us today

Tell us how we can be of service and one of our team members will contact you.

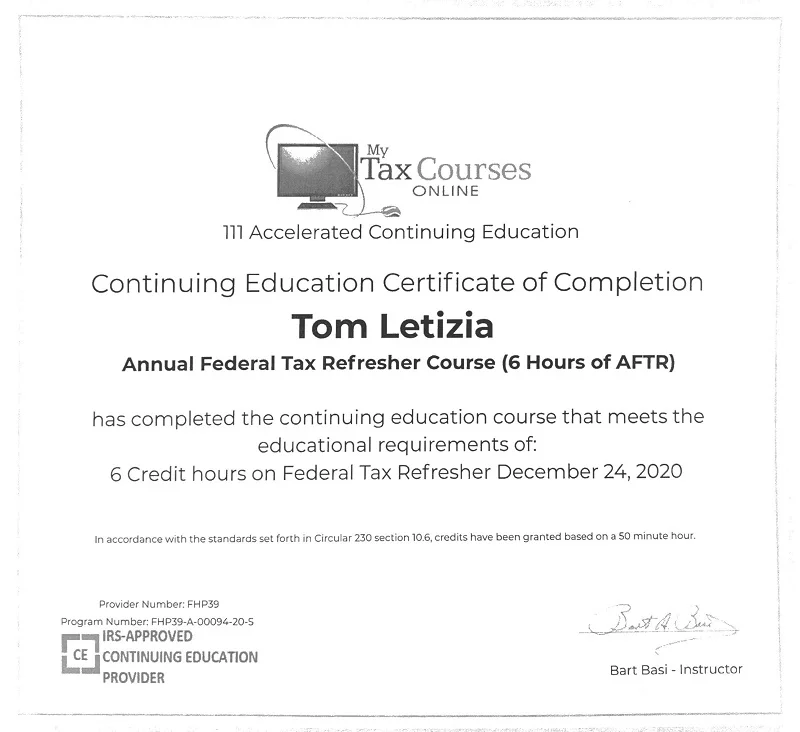

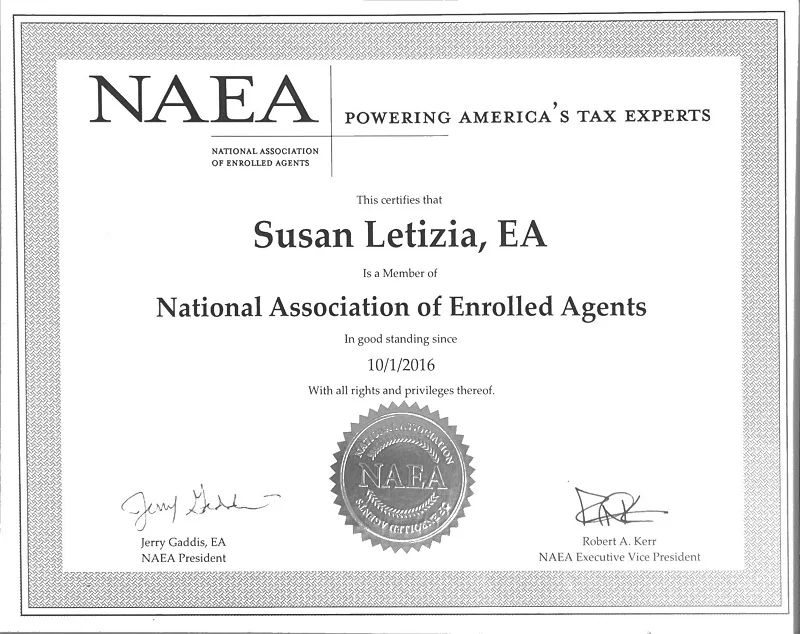

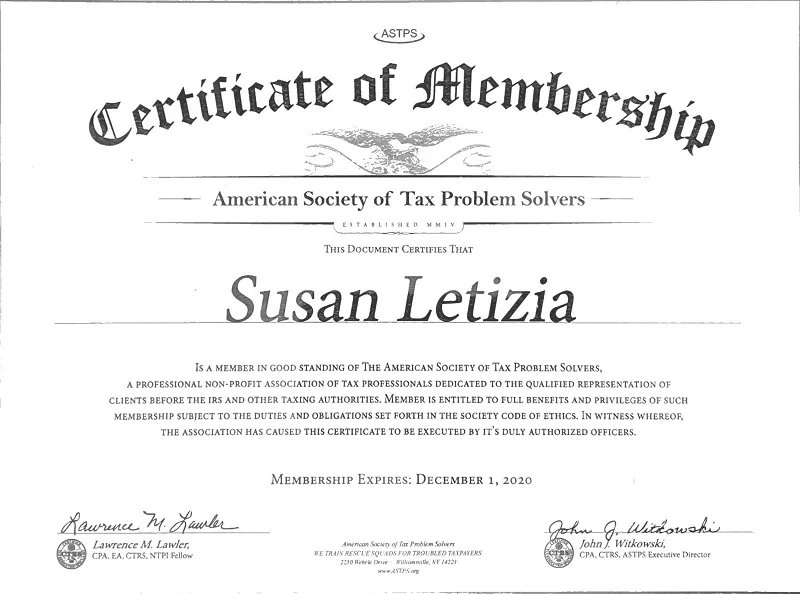

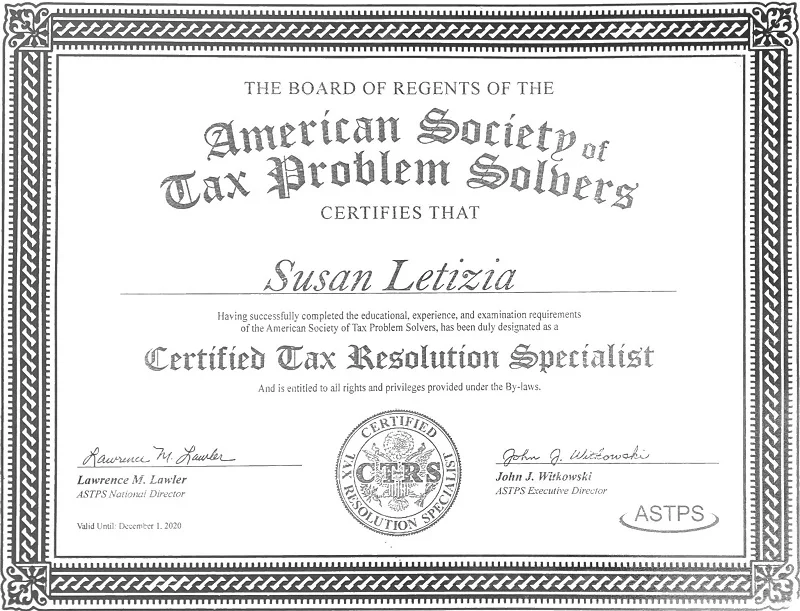

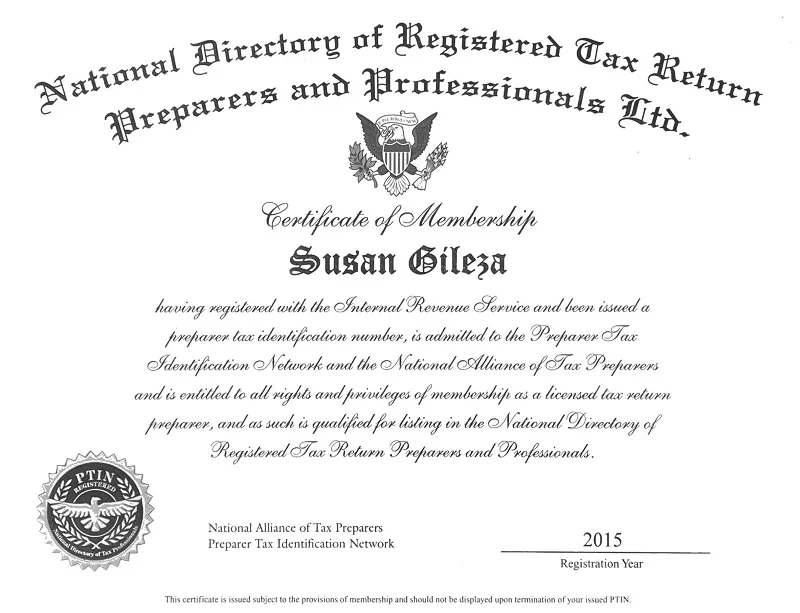

Certificates of SCL Tax Agents In & Near Bronx, NY

FAQ

Not just tax agent experts — a trusted team serving Bronx, NY, with clarity and compassion.

Read More >What is the difference between a “Tax Agent” and other tax professionals like CPAs or Enrolled Agents?

In the united states, CPAs are state licensed and can handle taxes, audits, and financial reports. Enrolled Agents are licensed by the IRS and focus only on taxes and IRS issues. In the Bronx NY, our trusted tax professionals can guide you on which type of help fits your needs.

How can you verify the credentials of a tax preparer in New York?

Start by checking their PTIN on the IRS site and searching the IRS directory. Confirm CPA licenses with the NY State Education Department or Enrolled Agent status with the IRS. You can also check the NYS Tax Department list and look at reviews. For trusted tax services in NYC or Bronx NY, choose licensed tax professionals with proof of credentials.

What services does a “Tax Agent” provide?

A tax agent files tax returns, gives tax advice. They help with audits, payment plans, payroll, and sales tax. Some also handle business, international, or retirement tax. If you need tax services in Bronx, NY, our tax professionals can make sure your taxes are accurate and on time.

Do tax agents specialize in business or individual taxes?

Tax agents handle either individual taxes or business taxes. Some do both. Individual tax agents focus on wages, deductions, and credits. Business tax agents work on company returns, payroll, and partnerships. Many CPAs and Enrolled Agents cover both, but most build skill in one area.

When choosing tax services in Bronx NY, pick an agent who works with cases like yours.

How can a tax agent help New York City residents with local tax obligations?

A tax agent can help New York City residents by filing state and city returns, handling business taxes like the UBT, managing sales tax filings, and finding local property tax breaks. They also make sure deadlines are met and can deal with the tax office if issues come up.

What questions should be asked before hiring a tax agent in New York?

Before hiring a tax agent in NYC or Bronx NY, ask for their PTIN, CPA, EA, or attorney status. Ensure they have a NYTPRIN and they are aware of state and city taxes rules. Ask about fees, who prepares your return, and how they handle audits. Make sure they’ll sign, show ID, use secure methods, and never trust someone who promises big refunds or asks for sign in blank forms.