For taxpayers, it is crucial to stay on top of the key changes in tax rates. As the current year comes to an end, the IRS has announced new tax rate schedules and tax brackets for multiple tax breaks. The new federal income tax brackets and standard deductions are effective January 1, 2022.

In order to file your 2022 tax returns in 2023 in a correct manner, you should know how various tax brackets will apply to single individuals and married couples who file jointly.

Here is the tax information for 2022 that you should use to find out how much you will be paying for federal income taxes. These changes have been made in the face of the rising inflation.

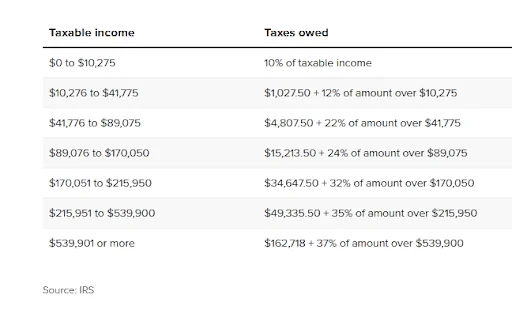

Individual Taxpayers (Single) Tax Rates 2022

If you are a single individual taxpayer, check out this table for the new tax rates that will apply to your taxable income in 2022.

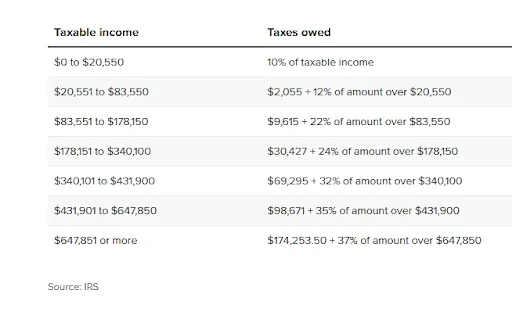

Married Taxpayers Filing Jointly Tax Rates 2022

If you are a married couple filing tax returns jointly, use this table to find out which tax bracket you fall into and how much you will pay on your taxable income. The lowest rate is 10% whereas the top tax rate is 37%.

As you see in the tables above, seven different tax rates are applicable for individual (single) taxpayers and married couple taxpayers in 2022: 10%, 12%, 22%, 24%, 32%, 35% and 37%. Based on your specific filing status, you can easily find which tax rate will apply in your case.

In short, the tax bracket you fall into will vary depending on a couple of factors including your total earnings, your total adjusted income and whether you are filing your tax returns jointly with your spouse or as an individual. Dependents, deductions and credits are some other factors which will determine which tax bracket applies in your case and how you will pay in taxes. The US tax system is a progressive one; the more you earn, the more tax you will owe.

2022 Standard Deduction

The IRS has increased the standard deduction amounts for 2022 to $25,900 for married couples filing jointly and $12, 950 for single individual taxpayers. For heads of households, the new standard deduction amount is $19,400. Likewise, the standard deduction amount has also been increased for other filing statuses such as those who are aged, blind and unmarried aged and blind taxpayers. A standard deduction is a flat deduction available to individual taxpayers.

For detailed information on standard deduction amounts, reach out to one of our tax experts at SCL Tax Services In & Near Bronx, NY.

Alternative Minimum Tax (AMT) Exemption Amount

Imposed on an alternative, the AMT places a floor on the % of taxes that a taxpayer must pay the federal taxing authority. In light of higher inflation, the IRS has made changes to this tax exemption as well.

The AMT exemption amount in 2022 has been adjusted to $75,900 for single filers and $118,100 for married couples filing jointly.

Personal Exemption Amount

In 2022, the personal exemption amount is zero.

Popular Tax Credits And Deductions 2022

Earned Income Tax Credit

The earned income tax credit for the tax year 2022 is $6,935 for qualifying taxpayers having three or more qualifying children. To find out how income phaseouts will apply, you should get in touch with one of our tax professionals at the SCL Tax Services in the Bronx, NY.

Child Tax Credit

Since there was no congressional action on the Build Back Better Act till now, the child tax credit of $2,000 per qualifying child will be restored again. Income phaseouts will apply.

Adoption Credit

For an adoption of a child with special needs, the adoption credit amount is $14,890 for tax year 2022. For other child adoptions, the maximum credit that will be permitted is also $14,890. Get in touch with a tax professional or tax accountant to find out how income phaseouts apply.

Lifetime Learning Credit

If you are a single filer, the education tax credit will be phased out over $80,000. The credit amount for married couples filing jointly is $160,000 for the tax year 2022.

Need Detailed Tax Information?

In order to fall into a lower tax bracket, you should bring down the total taxable income. This can be done with the help of a professional tax preparation service or a competent tax professional. At SCL Tax Services, we have specialists to educate taxpayers in regard to the new IRS announcements as well as help taxpayers plan their taxes ahead of time in a strategic manner. Based in the Bronx, NY, we specialize in tax consultation, tax preparation, tax filing, tax refund etc.

We have helped the residents in and near the Bronx, Mount Vernon, Eastchester, Westchester, and Yonkers in New York.

You can get in touch with our tax office via a phone call or write us an email using the contact form below.