The tax system in the United States is a complex one. While tax is imposed both at the federal and state level, there are different types of them that apply for individuals and companies. If you are a taxpayer, you should definitely try to make sense of the basics of the US tax system and how the entire system functions. Most importantly, you should be aware of the tax brackets and tax rates, which are changed one financial year after another. For taxes due in April 2022, you should know the 2021 tax brackets and rates.

The federal income tax brackets and rates vary depending on your filing status. If you are a taxpayer, you will need to choose a filing status for yourself. For individuals, various filing statuses are as follows:

Below, we will talk about all these filing statuses and what kind of federal taxable income brackets and rates apply to each of them.

So, keep on reading!

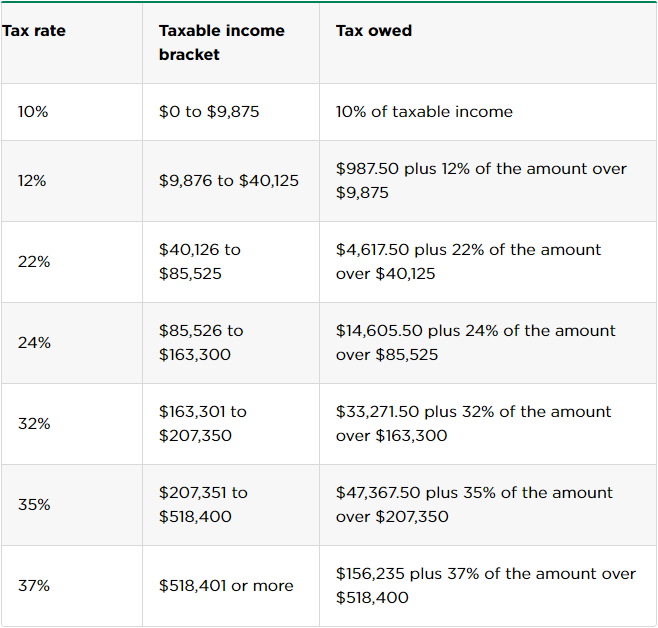

The single filers filing status refers to those individuals who are single. If you are an unmarried person and you do not qualify for any other filing status (as mentioned above), you are a single filer. It is important to note that many married people can also qualify for the status of single filer. This happens when you are married, but you have lived separately for the last six months of the tax year. The single filer status also applies if you have taken divorce from your spouse.

source: Nerdwallet

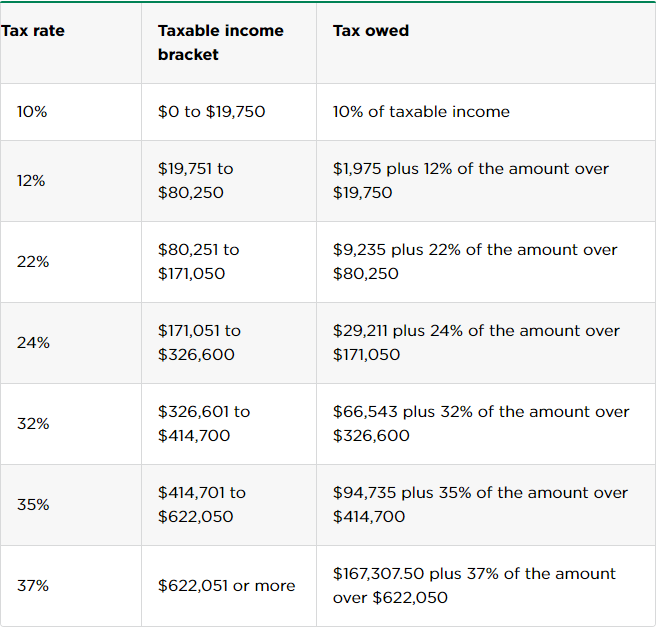

This tax status refers to married couples. If you have tied the knot before the end of the tax year, your filing status will be married filing jointly. Under this status, the married couple is allowed to furnish information about their respective incomes, tax deductions, credits and exemptions on one tax return. The married filing joint status is a perfect status for married couples where one spouse earns a considerable income. If both the spouses earn considerable incomes and the itemized deductions are huge as well as unequal, it is ideal to file separately.

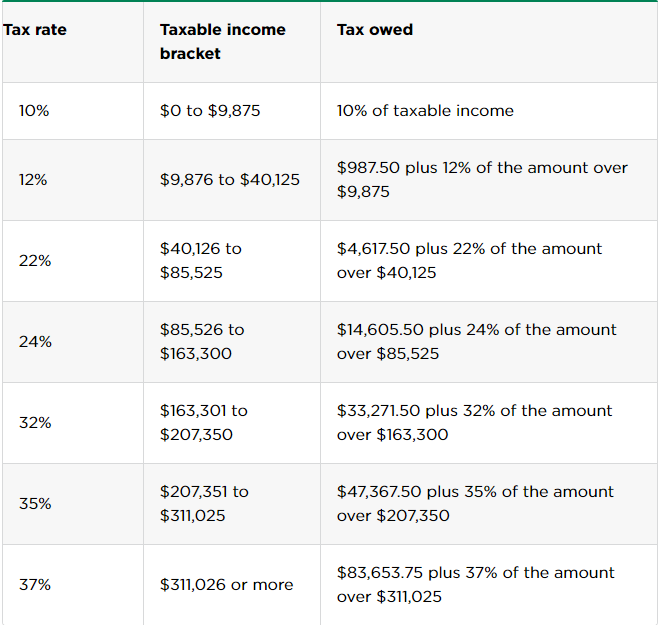

When a married couple files their income tax return separately, the tax status is known as married filing separately. In this case, each of the spouses will record their respective incomes, exemptions and tax deductions on separate returns. Married couples who choose this filing status can avail themselves of a potential tax benefit. You can receive the tax advantage when one of the spouses has large medical expenses and deductions or when both the spouses earn almost equally. Whether or not you should file separately depends on your specific financial situation.

Married filing separately status is the most ideal one to choose when filing jointly puts both of you into a higher tax bracket.

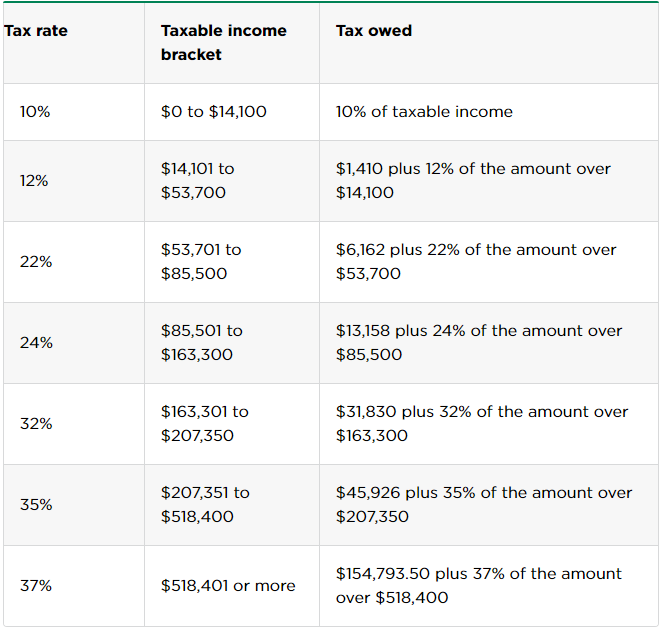

Taxpayers can also qualify for the HOH or Head of the Household status based on a specific set of criteria. You can file an income tax return as an HOH if you file a separate individual tax return, are considered unmarried, and are eligible for an exemption for housing a qualifying person. To file under this tax status, you must pay over one half of the cost of supporting and housing for the qualifying person. The qualifying person can be a child or a parent.

The average tax rate is calculated by dividing the total amount of tax by the total income. The marginal tax rate is different. This tax rate applies to the incremental income or the income in excess of the taxable income. As a taxpayer, it is crucial to understand the difference between marginal and average tax rate to make sense of how income tax rates actually work.

For example, if the total income of a household is $100,000 and the household pays a tax amount of $12,000, the average tax rate in this case is 12%. Marginal tax rate, on the other hand, increases as the taxable income goes up. For example, If a single filer taxpayer has a taxable income of $45,000, he would fall into the 22% income tax bracket. And if the taxable income increased by $1, the individual would pay 22% on the additional dollar, as well. For more information in this regard and to find out how the two tax rates apply in your financial situation, you should seek the expert consultation of an experienced accountant or tax professional in SCL Tax Services In & Near Bronx, NY.

As per the tax system in the United States, taxpayers with higher taxable income are required to pay a higher income tax rate to the federal government. If you fall into a particular bracket, it does not mean you will need to pay the tax rate on every type of income you earn. Just like people with higher taxable income pay higher income tax rates, those with lower taxable income pay lower income tax rate. So, your total taxable income will be divided into multiple chunks and each chunk gets taxed differently as per the applicable tax brackets.

The biggest advantage of tax brackets is that the taxpayer will not pay that rate on everything that they make.

If you have additional questions or want detailed information to make sense of your own unique financial situation, you should head straight to the SCL Tax Services In & Near Bronx, NY. We offer high quality and affordable tax help services and the most ideal solutions to a wide range of accounting, bookkeeping and tax problems. Our tax professionals carry in-depth IRS knowledge to get your taxes done right. Our experts will not only explain how various tax brackets and rates apply, but they will also help you get into the lowest tax bracket and minimize your tax bill.

At the SCL Tax Services, we have helped thousands of taxpayers reduce their tax bills through tax credits and deductions n and near the Bronx, Eastchester, Mount Vernon, Westchester, and Yonkers, New York. Give our tax office a phone call at +1-347-305-4348 or send our experts an email with contact form below to schedule your consultation now.

We are here to relieve you of the tax pressure by offering a wide range of Tax Services In & Near Bronx, NY. If you need expert advice or need us to complete your taxes, we will provide it for you. We know you work hard, so we work hard to serve your needs.

Your time is valuable, which is why we are here for you.